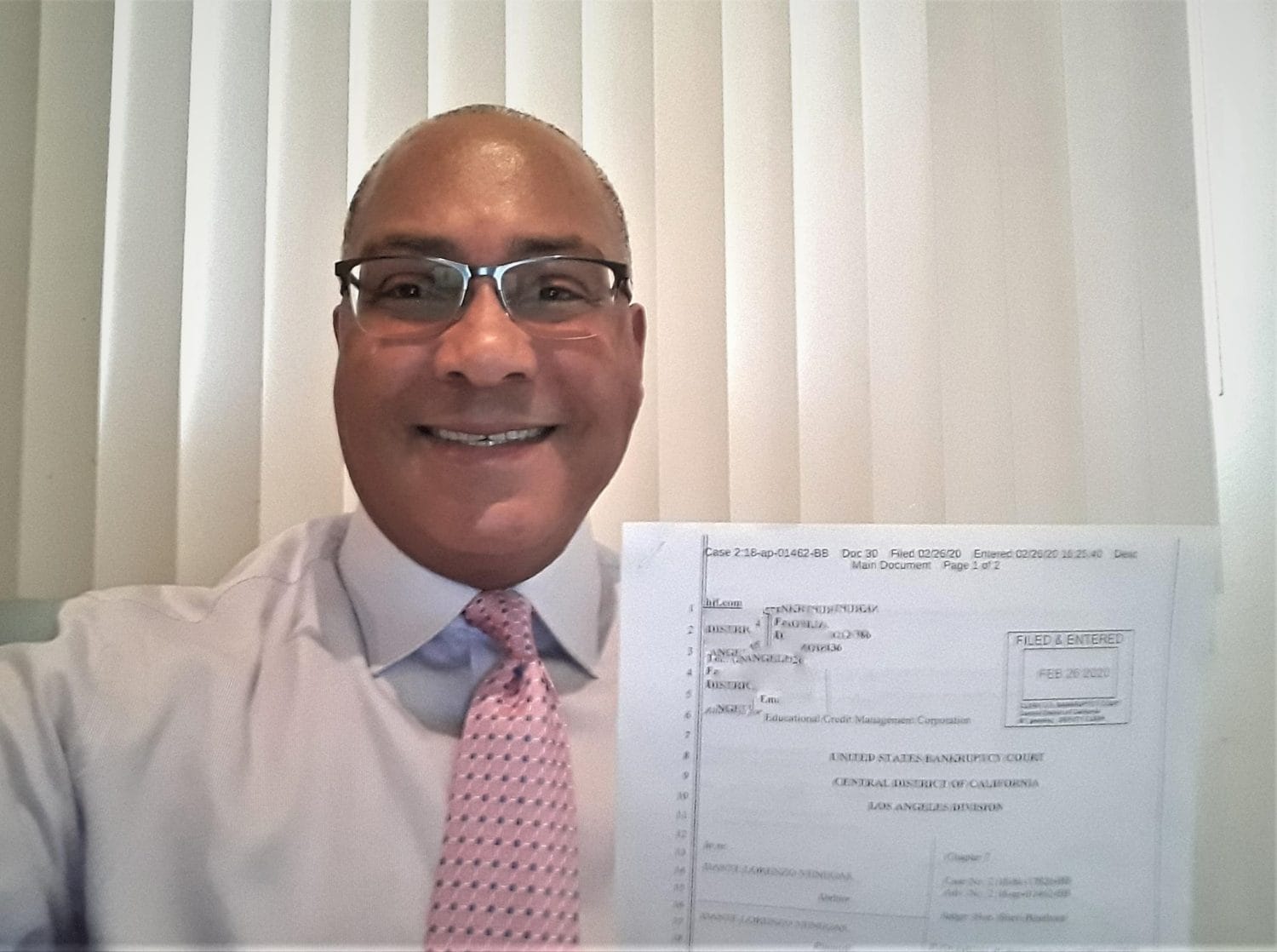

Dante Venegas struggled with student loans for 27 years and was able to get $327,000 in student loans discharged through Public Counsel’s Debtor Assistance Project

In Febuary, just weeks before the novel coronavirus devastated the U.S. economy and sent millions of Americans into unemployment, attorneys from Public Counsel and Greenberg Glusker relieved 55-year old substitute teacher Dante Venegas of $327,000 in student loan debt in his bankruptcy case. Venegas’s case marks the second and largest successful discharge of student loan debt through the assistance of Public Counsel’s Debtor Assistance Project, which provides legal assistance and pro bono representation to students struggling with overwhelming student loan debt.

After receiving his bachelor’s degree and paralegal certificate in the late 80’s and early 90’s, Dante’s student loans amounted to $28,000. For the next three decades, Dante worked tirelessly in his career, following opportunities to cities across California—including the Bay Area, Sacramento, San Diego and Los Angeles. Despite his best effort, he was unable to make a dent in his student loans. In that time, his student loans – originally only $28,000 – had ballooned to over $300,000 from interest, fees, and penalties. Dante’s financial situation became so dire that his 81-year-old mother moved in with him to help with rent and household expenses. When his mother’s physical disability worsened, Dante became her principal caregiver, all while trying to support himself and deal with his staggering student loan debt.

“While I was doing everything possible — forbearance, deferments and consolidations, and professional development — the debt kept growing,” said Venegas. “It became obvious that I was not going to be able to satisfy the full debt in my lifetime.”

After Dante filed for bankruptcy relief, he contacted Public Counsel’s Debtor Assistance Project for assistance with discharging his student loans. After assessing Dante’s case, Public Counsel connected him with attorneys John Mellisinos and Keith Patrick Banner from the law firm of Greenberg Glusker. Sadly, Mellisinos, whose work was invaluable in moving Dante’s case forward, passed away last year. Banner continued to represent Dante through the beginning of this year, and successfully obtained a discharged of $327,000 in student loans.

“The breath of fresh air feels like a second chance,” Venegas shared. “I am extremely grateful to Public Council and Greenberg Glusker LLP for helping me to emerge out of my insurmountable student loan debt.”

“This case is important, not just because of the relief it provided for Mr. Venegas, but because his story reflects a systemic problem in the student loan industry,” said Banner. “Even when someone ‘plays by the rules’ and diligently navigates the cumbersome procedures for deferments, forbearances, extended repayments and the slew of other programs available, the never-ending accumulation of interest too often results in debt that is impossible to get out from under. A change in policy is desperately needed and we hope cases like Mr. Venegas’ help push this critical discussion forward.”

Today, 44 million Americans collectively owe more than $1.6 trillion in student loan debt. And, student loan debt is a national issue with significant economic impacts.

“We need a bankruptcy system that accounts for the unduly harsh standards applied by courts and the staggering levels of student debt,” said Magdalena Reyes Bordeaux, attorney at Public Counsel. “There seems to be a myth among students, and even the legal community, that student loans can’t be discharged, but this case proves it is possible. As uncertainty grows across the nation, it is more important than ever to take on these cases because there are countless people like Dante who deserve a fresh start.”